knoxville tn state sales tax rate

The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. The local tax rate varies by county andor city.

Historical Tennessee Tax Policy Information Ballotpedia

Local Sales Tax is 225 of the first 1600.

. The average cumulative sales tax rate in Knoxville Tennessee is 925. The base state sales tax rate in Tennessee is 7. 24638 per 100 assessed value.

The Tennessee state sales tax rate is currently. This amount is never to exceed 3600. The maximum charge for county or city sales tax in Tennessee is 36 on the first 1600 of a cars purchase price.

The sales tax is comprised of two parts a state portion and a local portion. Average Sales Tax With Local. For example if you buy a car for 20000 then youll pay 1400 in.

The Tennessee state sales tax rate is currently. 925 7 state 225 local City Property Tax Rate. 212 per 100 assessed value.

The sales tax rate does not vary based on zip code. The state sales tax rate in Tennessee is 7000. The state sales tax rate in.

The local tax rate may not be higher than 275 and must be a multiple of 25. County Property Tax Rate. Knoxville TN Sales Tax Rate.

This includes the rates on the state county city and special levels. Tennessee sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Knoxville is located within Knox County Tennessee.

6 rows The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales. City of Knoxville Revenue Office. 3750 with affidavit of counseling.

Sales Tax Knoxville 225. 400 Main St Room 453. Within Knoxville there are around 31 zip codes with the most populous zip code being 37918.

The Tennessee state sales tax rate is currently. Local taxes apply to both intra-state and inter-state transactions. 5 Page Chapter 6.

Sales Tax State 700. Tennessee has state sales tax of 7 and allows local governments to collect a local option sales tax of up to 275. Food in Tennesse is taxed at 5000 plus any local taxes.

Purchases in excess of 1600 an additional state tax of 275 is added up to a. This is the total of state and county sales tax rates. The Knox County sales tax rate is.

Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975. 4 rows Knoxville TN Sales Tax Rate The current total local sales tax rate in Knoxville TN is. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections.

Local tax rates in Tennessee range from 0 to 3 making the sales tax range in Tennessee 7 to 10. To review the rules in Tennessee visit our state-by-state guide. There are a total of 307 local tax jurisdictions across the state collecting an average local tax of 2614.

Knoxville is a city in and the county seat of Knox County in the US. Business Tax Guide The Department of Revenue also offers a telecommunications device for the deaf TDD line at 615 741-7398. 3 rows The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and.

Local collection fee is 1. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. The general state tax rate is 7.

Current Sales Tax Rate. Kingsport TN Sales Tax Rate. Find your Tennessee combined state and local tax rate.

The Knoxville sales tax rate is. What is the sales tax rate in Knoxville Tennessee. The 2018 United States Supreme Court decision in South Dakota v.

Has impacted many state nexus laws and sales tax collection requirements. Tennessee has 779 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. State Sales Tax is 7 of purchase price less total value of trade in.

As reported by CarsDirect Tennessee state sales tax is 7 percent of a vehicles total purchase price. The 2018 United States Supreme Court decision in South Dakota v. 9750 without affidavit of counseling.

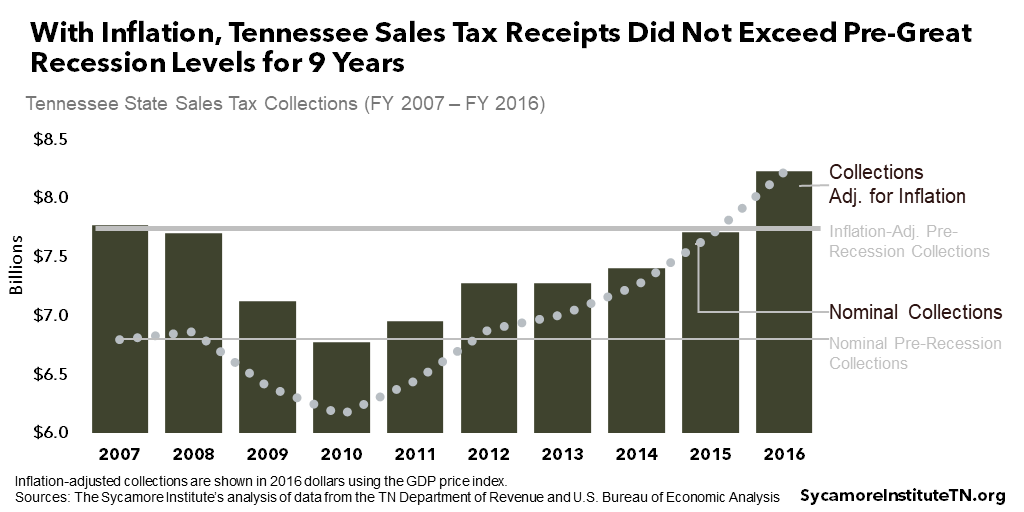

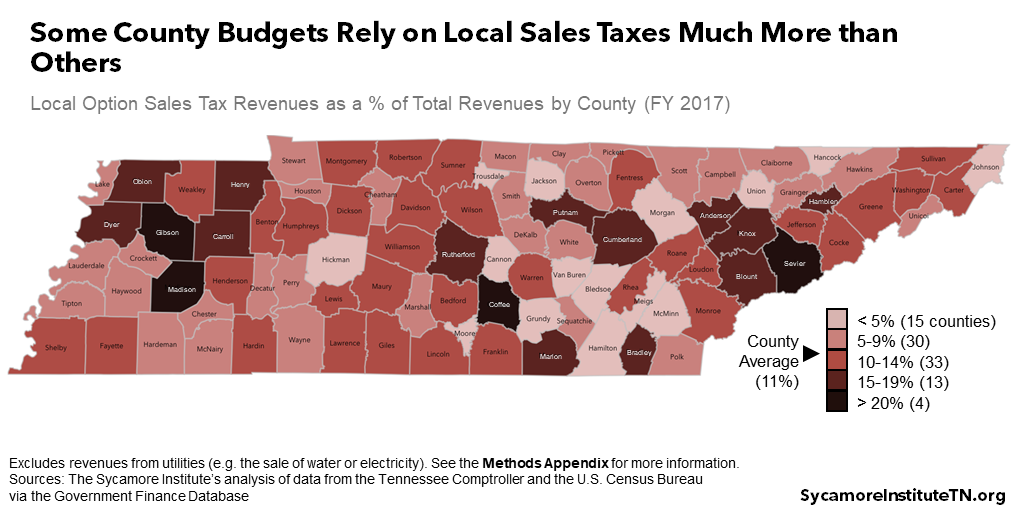

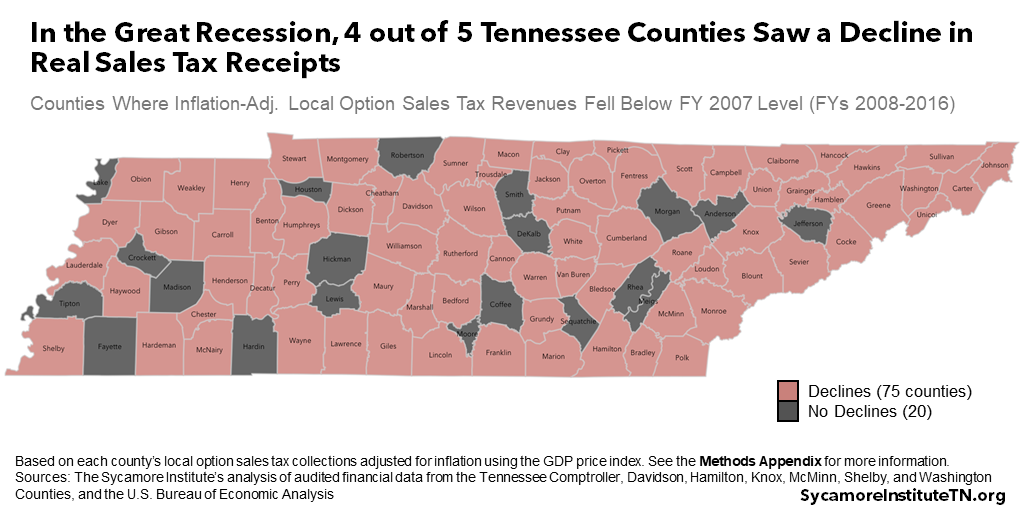

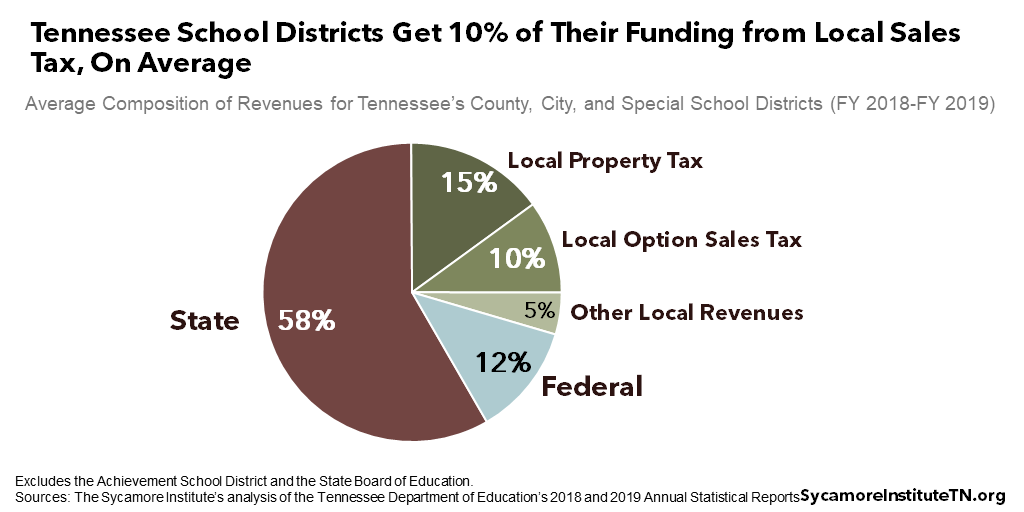

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Sales Tax Rates By City County 2022

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Year Specific Tax Rate Elasticities And Internet Penetration Rates Over Download Scientific Diagram

Pin On Across The Universe Straight Outta M Town

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Year Specific Tax Rate Elasticities And Internet Penetration Rates Over Download Scientific Diagram

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue